Beauty & personal care (BPC) gifting is nearly universal. Ninety-six percent (96%) have gifted a BPC item in this past, with 89% planning to do so now. Whether she’s part of the 33% of consumers planning to use generative AI for holiday shopping* this year, or if she’s braving the malls for a personal touch-and-feel before buying that glam gift for a special someone, your brand and your products are likely on her spend list. The Benchmarking Company surveyed 3,300+ women in November 2025 about their gifting plans this holiday season—as well as their beauty purging and replacement habits post-holiday. Get a jump on next year’s holiday season by understanding what puts your brand on the naughty or nice list in 2025.

Who’s She Spoiling Most

- 72% friend

- 70% family member (not spouse/child)

- 66% spouse/significant other

- 52% child

- 30% co-worker

Occasions That Spark BPC Gifting

- 85% holidays

- 82% birthdays

- 48% “just because”

- 43% appreciation

Brand opportunity: Beauty is no longer just a holiday moment—it’s an everyday “I’m thinking of you” category. Forward-thinking brands position products for spontaneous treats and everyday celebrations.

Why Beauty Wins: Her Gifting Mindset

- 63% choose items they would love to receive

- 61% love the self-care/pampering feel

- 61% believe everyone loves BPC gifts

- 59% say they’re practical and enjoyable

Her Beauty Gift Shopping List

What She’s Buying for Others

- 66% beauty gift sets

- 63% fragranced bath & body

- 59% full-sized fragrance/cologne

- 49% skincare

- 47% men’s grooming sets

- 41% luxury/limited-edition holiday sets

What She Wants to Receive

- 74% beauty gift set

- 66% Ulta gift card

- 65% full-sized fragrance

- 62% skincare bundle / Sephora gift card

- 54% aromatherapy

- 49% beauty device

- 48% hair care device

Gift Cards She’s Buying

- 40% Ulta

- 36% Sephora

- 35% Bath & Body Works

- 22% massage/spa/salon

Brand opportunity: Gift sets and fragrance dominate both purchase and desire—an ongoing chance to expand bundling, seasonal exclusives, and loyalty-driven gifting.

Top Purchase Influencers

- 76% product is on sale

- 61% price

- 59% scent

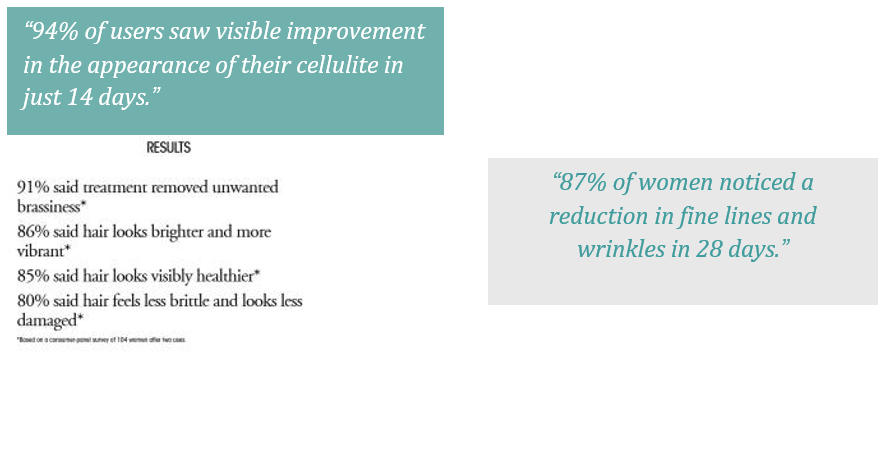

- 57% reviews/consumer claims

Innovation She’s Seeking

- 59% multi-functional products

- 51% proactive/age-prevention

- 30% scented hair products

- 29% new K-beauty

- 27% hair-growth devices/supplements

Brand opportunity: Value + scent + proof = conversion. Reviews, claims, and sampling opportunities are essential.

Where She Shops for BPC Gifts

- 68% Amazon

- 65% Target/Walmart

- 65% Ulta

- 59% Sephora

- 42% Brand website

She Shops the Deal Days

- 55% Black Friday

- 44% Cyber Monday

- 40% on her birthday

- 39% post-holiday

Holiday Hoarding

- 81% buy BPC for themselves during holiday sales

- 70% purchase extra gifts to use later

Why She’s Treating Herself

- 89% sale pricing

- 60% discovery

- 40% seasonal scents

Top Holiday Brands

Fragrance: Chanel, Dior, Dolce & Gabbana

Skincare: Olay, Clinique, Estée Lauder

Cosmetics: e.l.f., MAC, Maybelline

Bath & Body: Bath & Body Works, Burt’s Bees, Sol de Janeiro

Men’s Grooming: Dove Men+, Old Spice, Axe

Brand opportunity: Holiday = peak discovery season. Limited editions, seasonal scents, deluxe minis, and luxe kits can create strong trial and loyalty lift.

Purging: The Great Purge

- 64% purge yearly

- 63% sometimes

- 56% know how to check expiration

- 23% toss expired products regularly

Freshness Habits – Replacement Frequency

Mascara

- 62% annually

- 44% every 6 months

Annual replacement:

• 47% foundation

• 43% sunscreen

• 42% moisturizer

• 39% eye creams

How She Knows It’s Time to Toss

- 68% replace when empty

- 64% appearance/scent changes

- 51% expiration symbol

- 32% gets tired of product

What Prevents More Purging

- 58% feel wasteful

- 53% “just in case I need it”

- 43% guilt

Top Reasons for Purging

- 63% found a better product

- 57% sour smell

- 52% irritation

- 46% no longer needed

- 41% underperforms

How Purging Makes Her Feel

- 62% organized

- 40% refreshed

- 37% accomplished

Brand opportunity: Replacement marketing, education, and “fresh start” positioning can turn purging into a purchase-triggering moment.

Ready for Great Claims Like These in 2026? You Need Them!

Contact The Benchmarking Company to learn about consumer in-home use testing (IHUT) for marketing claims and risk mitigation.

*data by Deloitte: 2025 Deloitte Holiday Retail Survey