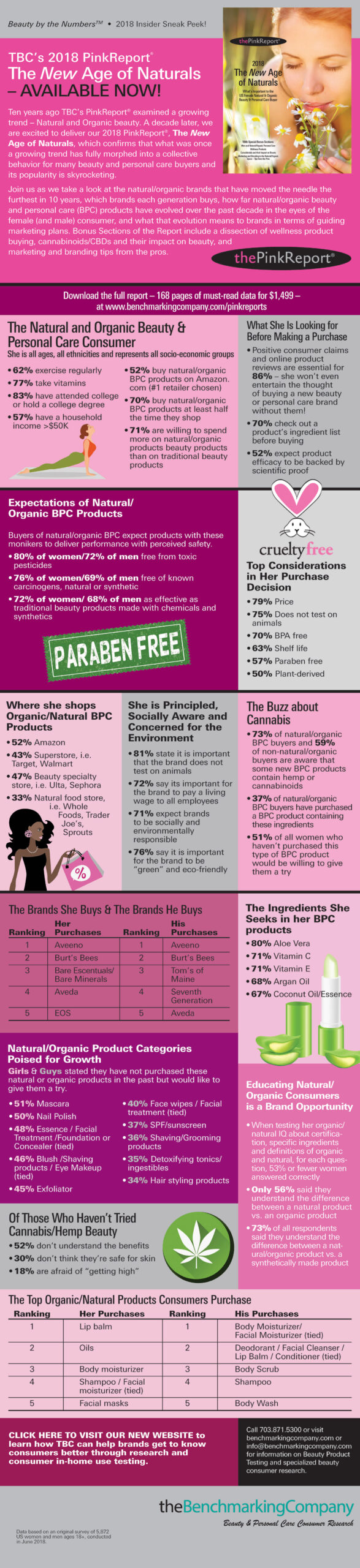

Interest in natural and organic cosmetics, skincare and hair care products have grown stronger in recent years. This infographic is a prelude to The Benchmarking Company’s PinkReport™: The New Age of Naturals. It includes details on what consumers expect from the organic/natural cosmetics label, giving brands better insight into how to market beauty products to appeal to this user base. At the top of the list is no animal testing. Eighty-one percent (81%) of respondents confirmed they value brands that don’t test on animals. However, that is far from the only concern for consumers, who are also interested in the health and environmental impact of a natural or organic lifestyle, as well as the social impact of the products they purchase.

CBD-based product usage and attitudes are also explored in this natural/organic infographic. We discovered that although a high number of consumers are curious about CBD, misconceptions abound about CBD products and their benefits. This is also true of many specific ingredients used in natural and organic products. While some consumers have taken a staunch position against products that they consider to be solely synthetic, they have difficulty differentiating what makes an ingredient organic versus natural. Increased education on these ingredients, including CBD, could help brands capitalize on user interest and promote sales.