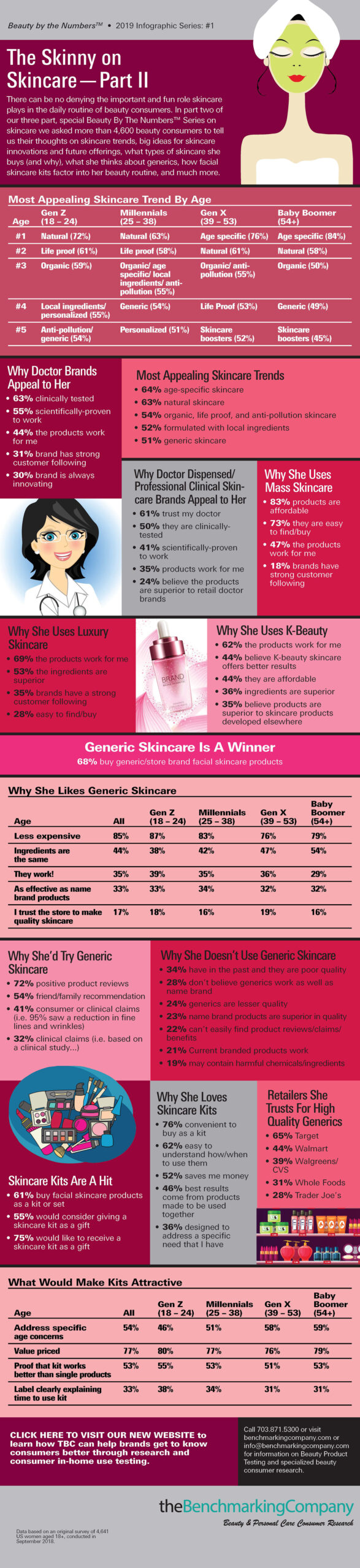

While skincare has been a critical component of the beauty industry for years, today’s consumers’ concerns and behavior aren’t the same as those of past generations. To help beauty brands determine how best to move forward into tomorrow’s markets, we decided to take a look into how beauty trends, technological interests (think social media), and modern perspectives can help shape the future of skincare.

In addition to showcasing skincare trends that are most popular within each generation, The Benchmarking Company’s original research delved into subcategories of skincare, including brands recommended by doctors, brands considered to be luxurious and elite, brands under the Korean beauty umbrella, and mass-produced or generic brands. While the skincare market statistics in each category proved to be illuminating, we examined why generic skincare remains an incredibly popular choice, despite the exciting and seemingly more innovative alternatives. On the flipside, with the marked preference of the audience overall, some users refuse to use generic products. Comparing the responses from both types of buyers provides a unique insight into what modern consumers truly value, helping brands to formulate a successful marketing strategy to march into the next stage of skincare.