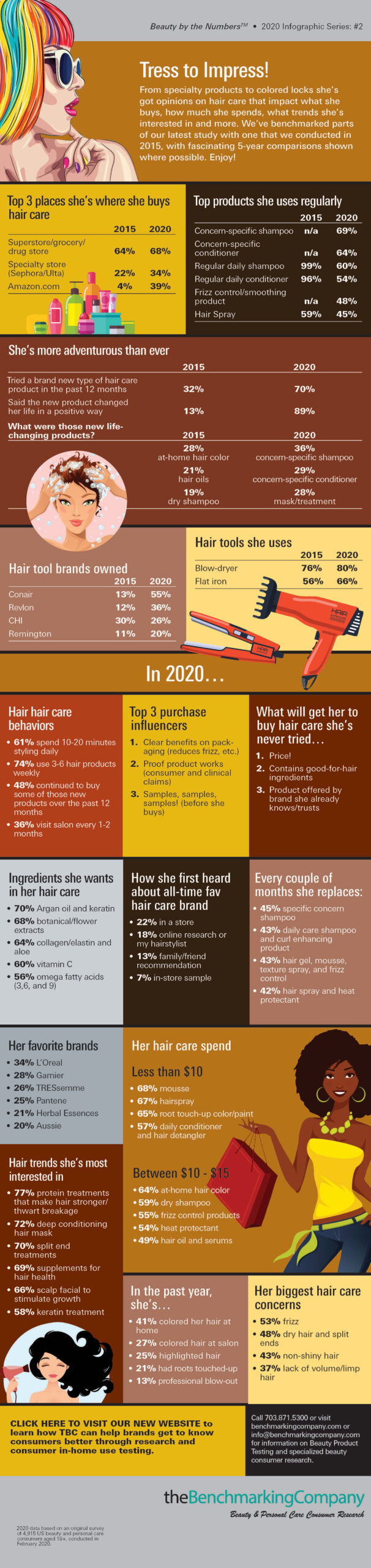

Hair types and hair care regimens may vary, but one thing is clear: this is the year for hair adventures! The number of women who tried a new product increased from 32% to 70% during the past five years, and satisfaction with these products increased as well. That means that more women than ever are exploring new and bolder hair care regimens, making it a prime time to attract new customers and introduce them to your products.

Women have strong preferences when it comes to where they shop and how they choose to spend their money, and hair care buying is no different. Within this infographic, you’ll find need-to-know information on how best to appeal to buyers looking to experiment with their hair, from product priorities, preferred ingredients, and how best to catch her attention. You’ll also learn about their hair care routines and concerns, giving you valuable insight into your target audience. These detailed hair care market trends are critical to formulating a comprehensive marketing plan that will allow your brand to stand out from other businesses.