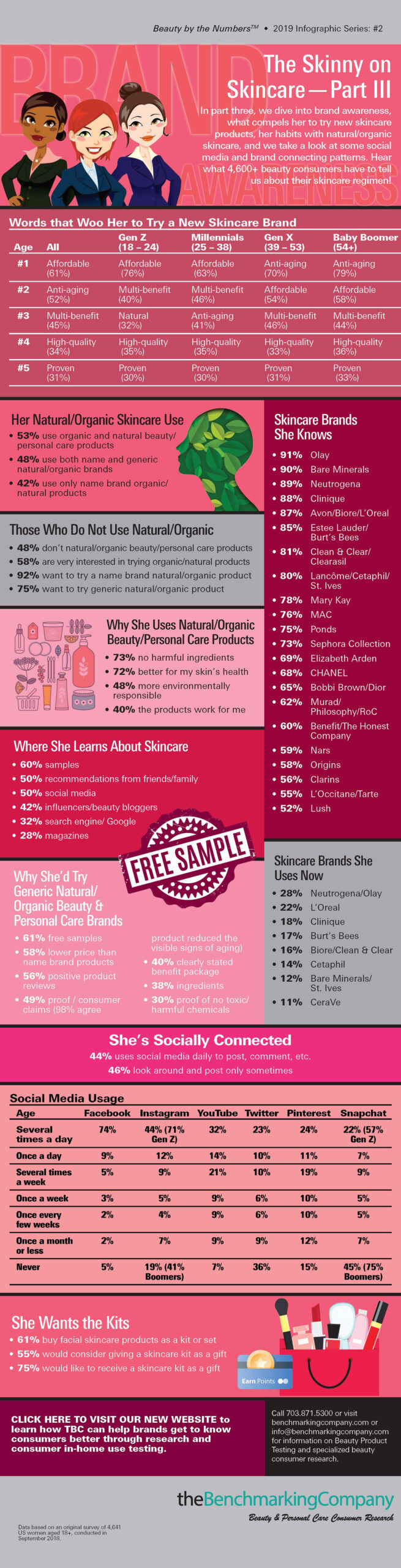

Ingredients in skincare products are important components; however, they’re not enough to guarantee market success. Other factors, such as price, familiarity, and branding, can greatly impact whether consumers choose to make a purchase. To better understand why consumers favor certain products and what variables might convince them to try something new, we surveyed more than 4,600 responses from US beauty consumers.

Today’s infographic data showcases the skincare brands that hold the highest degree of trust and market visibility amongst today’s consumers, and which ones are most popular. Also included is information detailing where users are likely to stumble upon new brands, and what sorts of incentives are most convincing, ranging from free samples to positive reviews and consumer claims.

Women are particularly interested in exploring skincare kits. In fact, we found that over 61% would purchase skincare products if they were in some sort of kit or set. Given that many products are developed to be used in conjunction with other products, this makes sense. Women appreciate the convenience and affordability of having a selection of bundled skincare items.